Your Path to Financial Freedom: Real Stories from Barr Advanced Tax Solutions

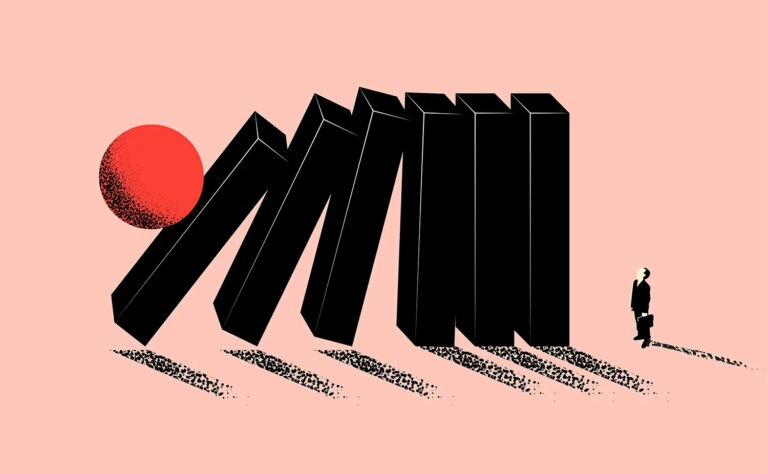

Amanda, a pediatrician with her own practice in Metairie, was earning $900,000 but feeling stuck. She was working long hours but not seeing the financial rewards she expected.

Elena, a partner at a mid-sized law firm in Baton Rouge, was earning $800,000 but felt overwhelmed by her tax situation. She was working harder each year but not seeing the financial progress she desired.

John, a dedicated ER doctor in Baton Rouge, was earning $550,000 annually. Despite his significant income, he felt trapped in a cycle of high taxes and limited savings. Can you relate to that feeling of working hard but not seeing the full fruits of your labor?

Mark and Lisa, both teachers in Shreveport, had a combined income of $500,000 thanks to their side business creating educational materials. They were proud of their success but stressed about the increasing complexity of their taxes.

Michael, owner of a thriving local restaurant chain in New Orleans, saw his W-2 income rise to $650,000. While proud of his success, he was concerned about the impact of taxes on his ability to expand his business.

Robert, a marketing executive in Lafayette, was earning $1.2 million annually but felt like he was on a financial treadmill. Despite his high income, he wasn't seeing the growth in his net worth that he expected.

Sarah, a software engineer in New Orleans, saw her income jump to $750,000 after a promotion and stock option grant. While excited about the opportunity, she was overwhelmed by the tax implications. Does this sound familiar?